Borrow Against your

Native, Unwrapped Bitcoin

Native, Unwrapped Bitcoin

The first cross-chain money market for BTC and major assets, built directly

on Chainflip’s proven DEX infrastructure.

For more information on lending, you can read our blog post covering the details.

Borrow Against your

Native, Unwrapped Bitcoin

Native, Unwrapped Bitcoin

The first cross-chain money market for BTC and major assets, built directly

on Chainflip’s proven DEX infrastructure.

For more information on lending, read our blog post covering the details.

Borrow Against

your Native, Unwrapped Bitcoin

your Native, Unwrapped Bitcoin

The first cross-chain money market for BTC and major assets, built directly on Chainflip’s proven DEX infrastructure.

For more information on lending, you can read our blog post covering the details.

Closed Beta Incentives

Closed Beta Incentives

Closed Beta Incentives

Earn FLIP by helping us battle-test Chainflip Lending before launch. Selected users get access

to a 25,000 FLIP rewards pool for supplying, borrowing, and triggering key on-chain actions

during the 30-day beta.

Turn stablecoins into reliable yield with zero hassle. Chainflip’s Automated Stablecoin Strategies offer a hands-off way to grow

your capital while strengthening the DeFi ecosystem.

Turn stablecoins into reliable yield with zero hassle. Chainflip’s Automated Stablecoin Strategies offer a hands-off way to grow your capital while strengthening the DeFi ecosystem.

Two Reward Pools, One Program

Two Reward Pools,

One Program

Earn points across both liquidity and action-based activities. Your share of the total points = your share of the FLIP airdrop.

Tap into stablecoin trading strategies that generate passive income, with no need to trade or track markets yourself.

Tap into stablecoin trading strategies that generate passive income, with no need

to trade or track markets yourself.

Supply & Borrow to Earn More

Supply & Borrow to Earn More

Deposit stable assets or borrow against your collateral. Borrowing earns 2x the points of supplying to incentivise deeper liquidity.

Deploy capital at desired spread for each stable asset. Fine-tuned to adapt with market conditions and optimise your returns.

Deploy capital at desired spread for each

stable asset. Fine-tuned to adapt with market conditions and optimise your returns.

Maximise With Smart Loops

Set-and-forget

Simplicity

Maximise With Smart Loops

It’s profitable to supply and borrow your own assets. Strategic looping increases average pool share and boosts your airdrop allocation.

Start earning in just a few clicks. With one-sided stablecoin deposits and an intuitive interface, anyone can participate without prior DeFi experience

or complex setup.

Start earning in just a few clicks. With one-sided stablecoin deposits and an intuitive interface, anyone can participate without prior DeFi experience or complex setup.

Trigger Actions, Earn Big

Balance Your

Portfolio

Trigger Actions, Earn Big

Liquidations and advanced positions award bonus points. High-impact testing =

high-impact rewards.

Let your stablecoin deposits generate yield in the background while you explore other yield opportunities in our product suite.

Let your stablecoin deposits generate yield

in the background while you explore other

yield opportunities in our product suite.

FLIP Airdrop Delivered Directly

FLIP Airdrop Delivered Directly

At the end of the season, your FLIP will be airdropped straight to your Ethereum refund address, no claiming, no friction.

Enhanced liquidity depth and protocol efficiency across the Chainflip ecosystem, unlocking better trading experience and greater

long-term earning potential.

What makes Chainflip Lending different

What makes Chainflip Lending different

What makes Chainflip Lending different

Until now, BTC lending has relied on wrapped assets and permissioned infrastructure. That approach limits transparency, introduces synthetic risk, and makes true permissionless lending impossible.

Until now, BTC lending has relied on wrapped assets and permissioned infrastructure. That approach limits transparency, introduces synthetic risk, and makes true permissionless lending impossible.

Native Assets Only

Lend or borrow real BTC, ETH, SOL, and stablecoins directly. No wrapped tokens or bridges, just native assets, managed

by Chainflip’s vault system.

Lend or borrow real BTC, ETH, SOL, and stablecoins directly. No wrapped tokens

or bridges, just native assets, managed

by Chainflip’s vault system.

Lend or borrow real BTC, ETH, SOL, and stablecoins directly. No wrapped tokens

or bridges, just native assets, managed

by Chainflip’s vault system.

Safe by Design

Every loan is overcollateralised and priced using verified Chainlink oracles, with fallback feeds on Ethereum

and Arbitrum for extra reliability.

Every loan is overcollateralised and

priced using verified Chainlink oracles,

with fallback feeds on Ethereum

and Arbitrum for extra reliability.

Every loan is overcollateralised and

priced using verified Chainlink oracles, with fallback feeds on Ethereum

and Arbitrum for extra reliability.

Cross-Chain by Default

Deposit collateral on one chain and borrow on another, all natively. Chainflip’s cross-chain settlement layer handles everything on-chain, removing friction between ecosystems.

Transparent & Composable

All positions, rates, and liquidations are avaliable for the user. Developers can integrate lending flows, monitoring, or liquidation data directly through our open API stack.

All positions, rates, and liquidations are visible and auditable on-chain. Developers can integrate lending flows, monitoring,

or liquidation data directly through our

open API stack.

All positions, rates, and liquidations

are visible and auditable on-chain. Developers can integrate lending flows, monitoring, or liquidation data directly through our open API stack.

For borrowers and lenders alike

For borrowers and lenders alike

Get early access

to Native Lending

Borrowers

Access liquidity without leaving Bitcoin

Borrow stablecoins or other assets directly against your

BTC, ETH, or SOL, without wrapping, bridges, or custodians.

Borrowers

Access liquidity without leaving Bitcoin

Borrow stablecoins or other assets directly against your BTC, ETH, or SOL, without wrapping, bridges,

or custodians.

Borrowers

Access liquidity without

leaving Bitcoin

leaving Bitcoin

Borrow stablecoins or other assets directly against your BTC, ETH, or SOL, without wrapping, bridges, or custodians.

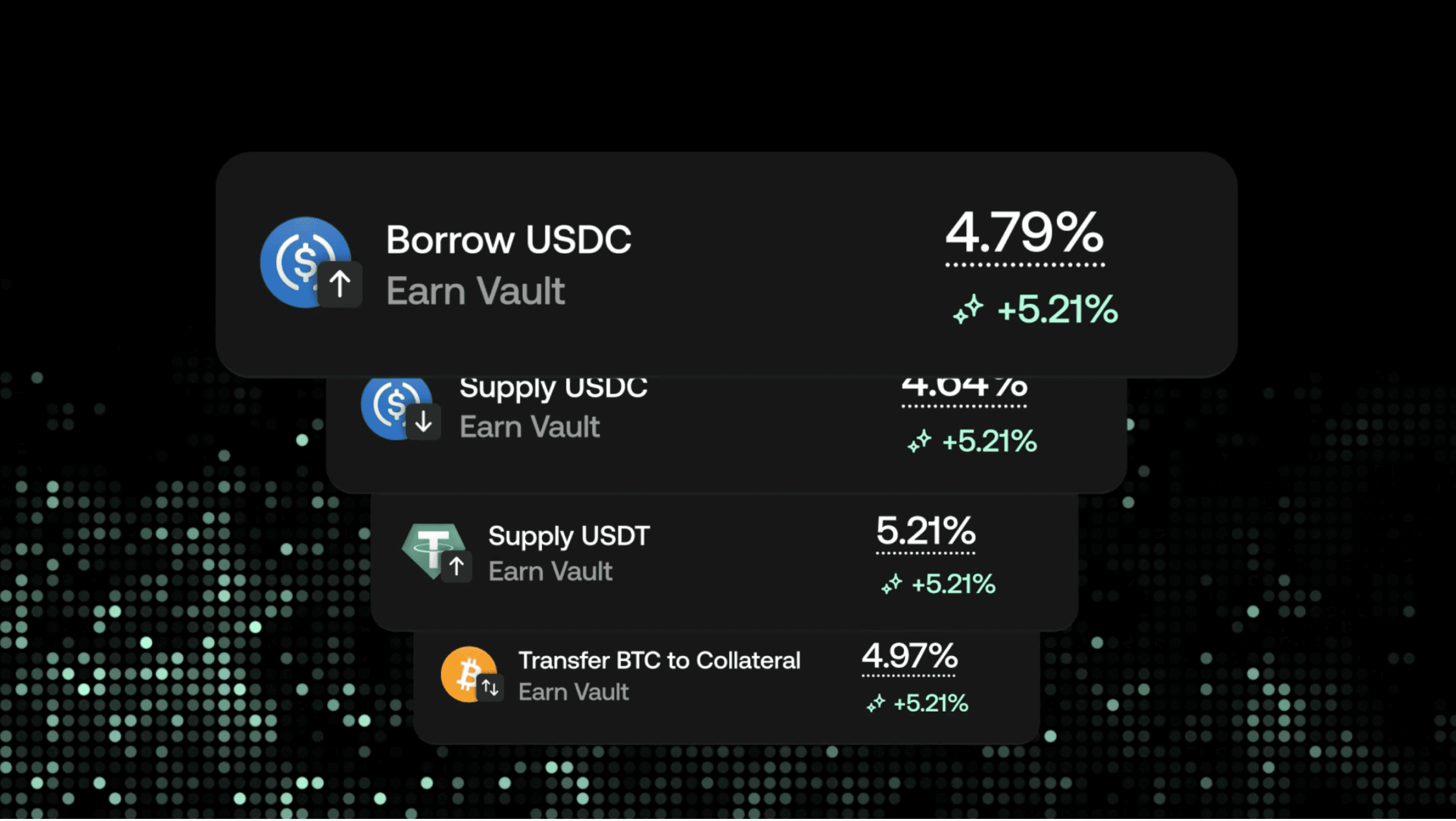

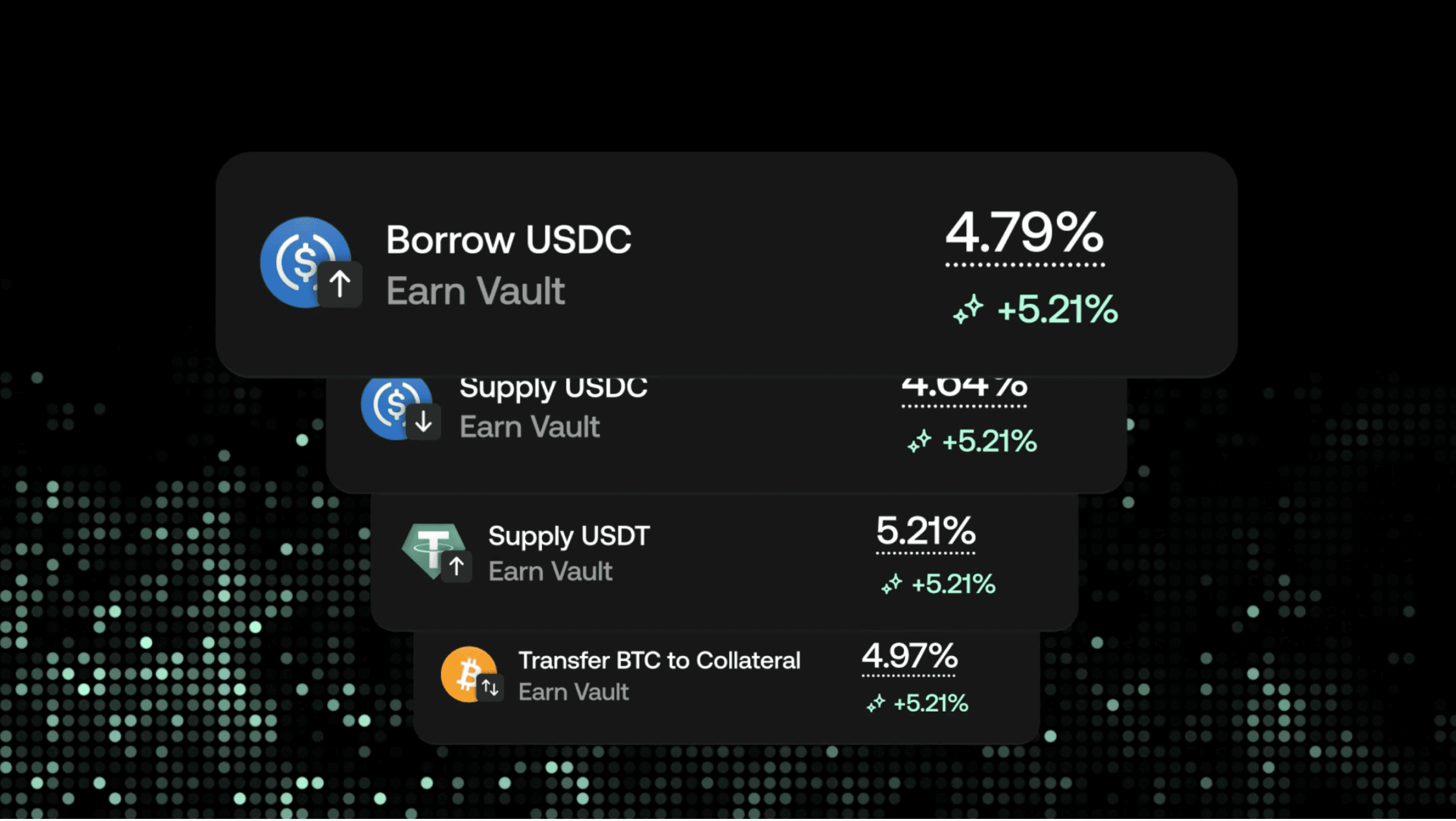

Lenders

Earn from real on-chain activity

Supply USDC, USDT, BTC and more

to earn competitive yield on your assets.

Lenders

Earn from real on-chain activity

Supply USDC, USDT, BTC and more

to earn competitive yield on your assets.

Lenders

Access liquidity without

leaving Bitcoin

leaving Bitcoin

Supply USDC, USDT, BTC and more

to earn competitive yield on your assets.

One protocol, two sides

of the same market

of the same market

One protocol, two sides

of the same market

of the same market

One protocol,

two sides of

the same market

two sides of

the same market

Chainflip Lending combines proven cross-chain infrastructure with

on-chain credit mechanics, creating a unified liquidity layer for native assets.

Chainflip Lending combines proven

cross-chain infrastructure with

on-chain credit mechanics, creating

a unified liquidity layer for native assets.

Be among the first to test

native Bitcoin lending

native Bitcoin lending

Get early access to Chainflip Lending and native Bitcoin loans, fully on-chain.

Test the system before launch and help shape what’s next.

For more information on lending, you can read our blog post covering the details.

Be among the first to test

native Bitcoin lending

native Bitcoin lending

Get early access to Chainflip Lending and native Bitcoin loans, fully on-chain.

Test the system before launch and help shape what’s next.

For more information on lending, read our blog post covering the details.

Get early access

to native Bitcoin lending

Get early access to Chainflip Lending and native Bitcoin loans, fully on-chain. Test the system before launch and help shape what’s next.

For more information on lending, you can read our blog post covering the details.

Frequently asked questions

Frequently asked questions

Frequently asked questions

What is Chainflip Lending?

Chainflip Lending is a native, cross-chain protocol for borrowing and lending. It lets users deposit collateral on one chain and borrow on another — entirely with native assets, without wrapping or synthetic tokens.

What is Chainflip Lending?

Chainflip Lending is a native, cross-chain protocol for borrowing and lending. It lets users deposit collateral on one chain and borrow on another — entirely with native assets, without wrapping or synthetic tokens.

What is Chainflip Lending?

Chainflip Lending is a native, cross-chain protocol for borrowing and lending. It lets users deposit collateral on one chain and borrow on another — entirely with native assets, without wrapping or synthetic tokens.

Which assets are supported?

The protocol currently supports Bitcoin, Ethereum, and Solana networks. The user can borrow USDT and USDC on Ethereum, as well as native ETH, BTC, and SOL on designated chains.

Which assets are supported?

The protocol currently supports Bitcoin, Ethereum, and Solana networks. The user can borrow USDT and USDC on Ethereum, as well as native ETH, BTC, and SOL on designated chains.

Which assets are supported?

The protocol currently supports Bitcoin, Ethereum, and Solana networks. The user can borrow USDT and USDC on Ethereum, as well as native ETH, BTC, and SOL on designated chains.

How does Chainflip Lending work?

Chainflip Lending operates on the Chainflip DEX, a cross-chain exchange secured by 150 validators and a unified liquidity layer. The DEX executes transactions, while the underlying appchain coordinates logic and validators settle funds across supported chains. See docs for more details.

How does Chainflip Lending work?

Chainflip Lending operates on the Chainflip DEX, a cross-chain exchange secured by 150 validators and a unified liquidity layer. The DEX executes transactions, while the underlying appchain coordinates logic and validators settle funds across supported chains. See docs for more details.

How does Chainflip Lending work?

Chainflip Lending operates on the Chainflip DEX, a cross-chain exchange secured by 150 validators and a unified liquidity layer. The DEX executes transactions, while the underlying appchain coordinates logic and validators settle funds across supported chains. See docs for more details.

What does over-collateralised mean?

It means you deposit more in collateral than the value of your loan. This ensures loans are safely backed, allows the protocol to recover funds through liquidations if prices drop, and keeps users and lending pools protected from insolvency.

What does over-collateralised mean?

It means you deposit more in collateral than the value of your loan. This ensures loans are safely backed, allows the protocol to recover funds through liquidations if prices drop, and keeps users and lending pools protected from insolvency.

What does over-collateralised mean?

It means you deposit more in collateral than the value of your loan. This ensures loans are safely backed, allows the protocol to recover funds through liquidations if prices drop, and keeps users and lending pools protected from insolvency.

Can I avoid being liquidated?

Yes. By keeping an eye on your loan-to-value (LTV) ratio and adding more collateral when markets move, you can stay safely above liquidation levels. The app shows your LTV in real time, helping you manage risk and maintain healthy positions even during volatile markets.

Can I avoid being liquidated?

Yes. By keeping an eye on your loan-to-value (LTV) ratio and adding more collateral when markets move, you can stay safely above liquidation levels. The app shows your LTV in real time, helping you manage risk and maintain healthy positions even during volatile markets.

Can I avoid being liquidated?

Yes. By keeping an eye on your loan-to-value (LTV) ratio and adding more collateral when markets move, you can stay safely above liquidation levels. The app shows your LTV in real time, helping you manage risk and maintain healthy positions even during volatile markets.

What are the associated risks?

On-chain lending carries both technical and market risks. Smart-contract or oracle failures can cause loss if exploited, while high volatility can trigger liquidations. Use the product responsibly — DeFi always involves potential loss of funds.

What are the associated risks?

On-chain lending carries both technical and market risks. Smart-contract or oracle failures can cause loss if exploited, while high volatility can trigger liquidations. Use the product responsibly — DeFi always involves potential loss of funds.

What are the associated risks?

On-chain lending carries both technical and market risks. Smart-contract or oracle failures can cause loss if exploited, while high volatility can trigger liquidations. Use the product responsibly — DeFi always involves potential loss of funds.